On Friday, August 26, Federal Reserve Chairman Jerome Powell warned that combating high inflation will likely mean higher interest rates “for some time. The historical record cautions strongly against prematurely loosening policy.” Speaking at the annual Jackson Hole Economic Policy … [Read more...] about 9.1.22: FED CHAIR POWELL SAYS HIGHER INTEREST RATES LIKELY TO LAST “FOR SOME TIME”

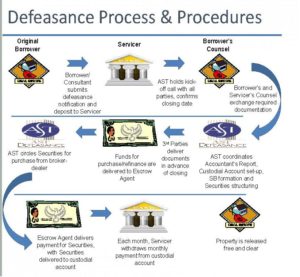

5.8.22: DEFEASANCE HEATS UP WITH RISE IN INTEREST RATES

Most CMBS conduit loans have a prepayment penalty called defeasance that gives borrowers the ability to unencumber the underlying real estate to sell or refinance the property. When a loan is defeased the borrower substitutes the existing collateral with a portfolio of U.S. securities structured to … [Read more...] about 5.8.22: DEFEASANCE HEATS UP WITH RISE IN INTEREST RATES

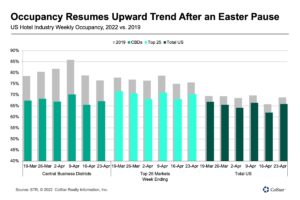

4.23.22: HIGHER RATES DRIVE U.S. HOTEL ROOM REVENUES ABOVE 2019 LEVELS

Higher rates continue to make up for lower occupancies across the U.S. hotel industry, pushing weekly room revenue higher than it was in 2019, but not high enough to negate the effects of inflation. Data from STR show U.S. hotel industry occupancy for the week ended April 23 rebounded from the … [Read more...] about 4.23.22: HIGHER RATES DRIVE U.S. HOTEL ROOM REVENUES ABOVE 2019 LEVELS

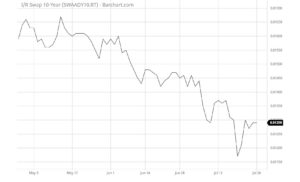

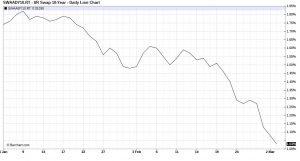

7.31.21: CMBS LOAN RATES NEAR RECORD LOWS AS TREASURY AND SWAP RATES FALL

The 10-year swap rate and 10-year Treasury rate have dropped gradually since May. This is despite an economic rebound that would suggest higher interest rates as the world recovers from the COVID-19 pandemic. The Federal Reserve, however, indicates it will be “highly accommodative for many years” … [Read more...] about 7.31.21: CMBS LOAN RATES NEAR RECORD LOWS AS TREASURY AND SWAP RATES FALL

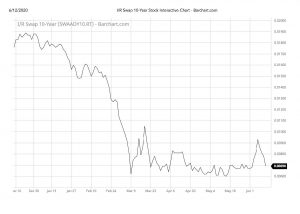

6.30.20: CMBS LOAN RATES CONTINUE TO DECLINE AS CMBS SPREADS RALLY

Spreads on CMBS securities declined in June, positively impacting CMBS conduit loan rates. The benchmark AAA-rated super-senior CMBS closed the month at 115 basis points (bp) over swaps, down from 145 bp over swaps on June 1. Super-senior AAA-rated CMBS spreads peaked in March during the height of … [Read more...] about 6.30.20: CMBS LOAN RATES CONTINUE TO DECLINE AS CMBS SPREADS RALLY

6.10.20: FEDERAL RESERVE SIGNALS LOW INTEREST RATES TO CONTINUE

The Federal Open Market Committee ended its two-day meeting on Wednesday holding its key interest rate near zero and signaled it likely won’t lift the key interest rate until at least 2022, noting the outbreak “will weigh heavily on economic activity” and “poses considerable risks to the economic … [Read more...] about 6.10.20: FEDERAL RESERVE SIGNALS LOW INTEREST RATES TO CONTINUE

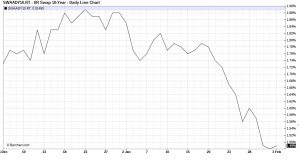

3.3.20: CMBS LOAN RATES AT RECORD LOWS AS TREASURY AND SWAP RATES FALL

The 10-year Treasury yield dropped to a record low on Tuesday as the historic decline in U.S. rates continued amid the coronavirus outbreak and the Federal Reserve’s 50-basis-point (bp) emergency interest rate cut two weeks before its March meeting. The 10-year Treasury yield fell to an intraday … [Read more...] about 3.3.20: CMBS LOAN RATES AT RECORD LOWS AS TREASURY AND SWAP RATES FALL

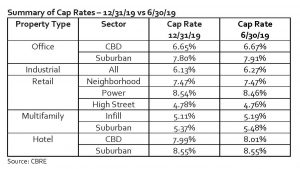

2.20.20: CBRE REPORTS ON CAP RATES AT YEAREND 2019

CBRE notes that capitalization rates (cap rates) were broadly stable in the second half of 2019 and relatively stable for full-year 2019 in its recently published survey for income producing commercial real estate (retail, office, industrial, multifamily and hotel) as of December 31, … [Read more...] about 2.20.20: CBRE REPORTS ON CAP RATES AT YEAREND 2019

2.3.20: INTEREST RATES TUMBLE TO UNDER 4% FOR CMBS CONDUIT LOANS ON CORONAVIRUS OUTBREAK

Interest rates for CMBS conduit loans have fallen to historic lows as the death toll from China’s coronavirus outbreak continues to rise, rattling investors worried about the financial impact on the world’s second-largest economy. In the United States, equity prices have gyrated, while Treasury … [Read more...] about 2.3.20: INTEREST RATES TUMBLE TO UNDER 4% FOR CMBS CONDUIT LOANS ON CORONAVIRUS OUTBREAK

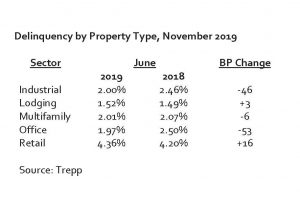

12.10.19: CMBS DELINQUENCY RATES CONTINUE TO DECLINE

The Trepp CMBS delinquency rate maintained its downward trend in November, falling sharply to another post-crisis low. The November reading was 2.34%, a month-over month drop of 13 basis points (bp). The delinquency rate is down 99 bp year over year. The delinquency rate started to fall after June … [Read more...] about 12.10.19: CMBS DELINQUENCY RATES CONTINUE TO DECLINE