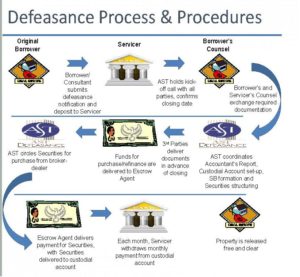

Most CMBS conduit loans have a prepayment penalty called defeasance that gives borrowers the ability to unencumber the underlying real estate to sell or refinance the property. When a loan is defeased the borrower substitutes the existing collateral with a portfolio of U.S. securities structured to … [Read more...] about 5.8.22: DEFEASANCE HEATS UP WITH RISE IN INTEREST RATES

11.22.19: HOW TO ESTIMATE DEFEASANCE COSTS FOR A CMBS CONDUIT LOAN

Most CMBS conduit loans feature defeasance as the method for loan prepayment before maturity. In layman’s terms, the lender releases the mortgage lien in exchange for securities, usually treasury bonds, that produce enough cash flow to make the remaining loan payments as they come due. If the total … [Read more...] about 11.22.19: HOW TO ESTIMATE DEFEASANCE COSTS FOR A CMBS CONDUIT LOAN

11.15.19: HOW TO USE A DEFEASANCE CALCULATOR

Most CMBS conduit loans feature defeasance as the method for loan prepayment before maturity (click here for details). Several well-qualified firms handle the defeasance process on behalf of borrowers, and each has a defeasance calculator on its website. Let’s walk through an example of how to … [Read more...] about 11.15.19: HOW TO USE A DEFEASANCE CALCULATOR

3.11.13: Rising Property Values, Low Rates Spur Increase in Defeasance

More borrowers are using defeasance to release properties from securitized mortgages so they can take advantage of improving market conditions to sell or refinance the assets, according to Commercial Mortgage Alert. Some $5.9 billion of U.S. loans in commercial MBS collateral pools were defeased … [Read more...] about 3.11.13: Rising Property Values, Low Rates Spur Increase in Defeasance