Key credit indicators for securitized commercial mortgages continued to strengthen in July, led by a big improvement in hotel performance. Analysts cautioned, however, that further recovery could be impeded by a rise in coronavirus cases tied to the delta variant. The 60-day delinquency rate among … [Read more...] about 8.17.21: CMBS LOAN METRICS CONTINUE TO IMPROVE

6.20.21: CMBS SPREADS CONTINUE TO TIGHTEN ON STRONG INVESTOR DEMAND

Strong demand led to tight pricing on newly issued CMBS securities amid the marketing of $10 billion of bonds. Wells Fargo, Morgan Stanley, Bank of America and NCB priced the $1-billion conduit issue on June 14, with the super-senior, long-term AAA-rated bonds pricing at 64 basis points (bp) over … [Read more...] about 6.20.21: CMBS SPREADS CONTINUE TO TIGHTEN ON STRONG INVESTOR DEMAND

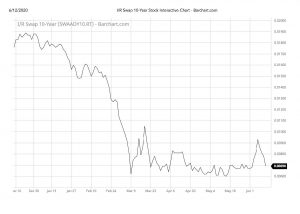

6.30.20: CMBS LOAN RATES CONTINUE TO DECLINE AS CMBS SPREADS RALLY

Spreads on CMBS securities declined in June, positively impacting CMBS conduit loan rates. The benchmark AAA-rated super-senior CMBS closed the month at 115 basis points (bp) over swaps, down from 145 bp over swaps on June 1. Super-senior AAA-rated CMBS spreads peaked in March during the height of … [Read more...] about 6.30.20: CMBS LOAN RATES CONTINUE TO DECLINE AS CMBS SPREADS RALLY

6.10.20: FEDERAL RESERVE SIGNALS LOW INTEREST RATES TO CONTINUE

The Federal Open Market Committee ended its two-day meeting on Wednesday holding its key interest rate near zero and signaled it likely won’t lift the key interest rate until at least 2022, noting the outbreak “will weigh heavily on economic activity” and “poses considerable risks to the economic … [Read more...] about 6.10.20: FEDERAL RESERVE SIGNALS LOW INTEREST RATES TO CONTINUE

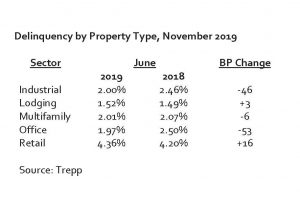

12.10.19: CMBS DELINQUENCY RATES CONTINUE TO DECLINE

The Trepp CMBS delinquency rate maintained its downward trend in November, falling sharply to another post-crisis low. The November reading was 2.34%, a month-over month drop of 13 basis points (bp). The delinquency rate is down 99 bp year over year. The delinquency rate started to fall after June … [Read more...] about 12.10.19: CMBS DELINQUENCY RATES CONTINUE TO DECLINE

4.18.19: Mall Giants Continue to Redevelop Vacant Department Stores

Mall owners Simon Property (NYSE: SPG) and Macerich Company (NYSE: MAC) continue to redevelop vacant department stores, creating substantial value for shareholders. In a recent earnings call, Simon reported that redevelopment activity is moving quickly, and in some cases, much quicker than … [Read more...] about 4.18.19: Mall Giants Continue to Redevelop Vacant Department Stores

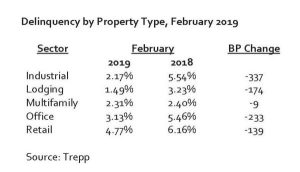

3.10.19: CMBS Delinquency Rates Continue to Decline

The Trepp CMBS delinquency rate broke through the 3% threshold in February 2019 as the reading continues its steady decline. The February reading fell 15 basis points (bp) to 2.87% from 3.02% registered in January. The February result is another post-crisis low. The delinquency rate is 164 bp lower … [Read more...] about 3.10.19: CMBS Delinquency Rates Continue to Decline

5.21.18: ICSC RECon Takeaway: Malls Will Continue to Shutter and Evolve

Concerns linger regarding the fate of malls in the United States, even as the sentiment among retail real estate professionals remained upbeat at this year’s ICSC RECon, held at the Las Vegas Convention Center in Las Vegas, Nevada. America’s nearly 1,200 malls will likely be reduced to 600, … [Read more...] about 5.21.18: ICSC RECon Takeaway: Malls Will Continue to Shutter and Evolve

8.25.16: Sears/Kmart Continue to Falter

Sears and Kmart continue to struggle in a retail environment in which only “best in class” retailers are able to grow sales and profits. Sales have declined for the last ten quarters, including a 7.1% decline in the fourth quarter of 2015 and an 8% decline in the first quarter of 2016. Sears stores … [Read more...] about 8.25.16: Sears/Kmart Continue to Falter

8.18.15: CMBS Prices Continue to Weaken, But Rebound Expected

CMBS spreads reached a two-year high amid high levels of issuance and volatility in world capital markets. The long-term, super senior bonds from the most recent offering, led by Wells Fargo and Societe Generale, priced at a spread of 120 basis points (bp) over swaps. This level was the same as the … [Read more...] about 8.18.15: CMBS Prices Continue to Weaken, But Rebound Expected