The Federal Open Market Committee ended its two-day meeting on Wednesday holding its key interest rate near zero and signaled it likely won’t lift the key interest rate until at least 2022, noting the outbreak “will weigh heavily on economic activity” and “poses considerable risks to the economic outlook.” To provide emphasis, Federal Reserve Chair Jerome Powell said in a virtual news conference, “We’re not even thinking about raising rates. We’re not even thinking about thinking about raising rates.”

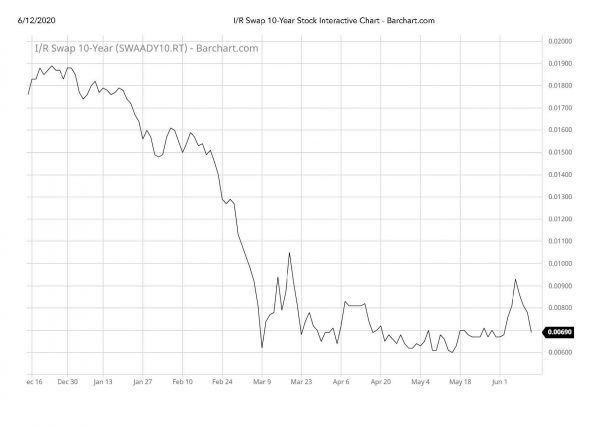

Key benchmark rates for CMBS conduit loans remain historically low. The 10-year swap rate, the benchmark for setting CMBS conduit loan interest rates, has closed in a range of 0.60% (the record low) to 1.00% since March 9 and is currently at 0.70%. Recall that interest rates for CMBS conduit loan rates are set by adding the 10-year swap rate plus the loan spread. Loan spreads are trending down after spiking due to COVID-19 concerns and are currently 325-375 basis points. Adding the current swap of 0.70% results in interest rates of 3.95%-4.45%.

For a free, no-obligation loan quote, contact a member of the ValueXpress team: Mike Sneden (mikes@valuexpress.com), Dennis Suh (dsuh@valuexpress.com) or Gary Unkel (gunkel@valuexpress.com).