Bridge Loans

Bridge loans are a complementary product for ValueXpress as bridge loans typically refinance into CMBS conduit loans.

Hampton Inn & Suites

Dallas, TX

$7,500,000 Bridge Loan

WHAT ARE BRIDGE LOANS?

Bridge loans are conventional primarily floating-rate first mortgage loans secured by unstabilized income-producing commercial real estate properties that have vacant or underutilized space that is being marketed to tenants.

Often these properties need to complete exterior or interior capital improvements to attract new tenants. Bridge loans often provide the capital for exterior or interior capital improvements, tenant improvements, leasing commissions and an interest reserve (if required). Bridge loans on hotels are typically provided for Property Improvement Plans (PIP) required to maintain an existing franchise affiliation or convert the property to a new franchise affiliation.

WHEN ARE BRIDGE LOANS A GOOD FIT?

Bridge loans are a good fit for unstabilized properties and/or properties that have yet to achieve their greatest value.

Bridge loans allow the property, when stabilized, to be refinanced into a permanent loan without incurring substantial prepayment penalties. Often, the prepayment penalty on a bridge loan is completely waived if the loan is refinanced into a permanent CMBS conduit loan. If the loan is refinanced into an alternative loan, the prepayment penalty is typically 1% of the loan amount.

Most bridge loans are non-recourse (no personal guarantees).

Bridge loans can be structured to include reserves for the capital improvements that are typically required to attract new tenants.

Holiday Inn Downtown

Houston, TX

$19,500,000 Bridge Loan

How Are Bridge Loans Underwritten?

Bridge loans are underwritten based both on the existing income generated from the property and the anticipated income that the property will generate when stabilized.

Guidelines for debt service coverage (DSCR) on existing income is 1.0x. Guidelines for DSCR when the property is stabilized are based on CMBS conduit loan guidelines. Bridge underwriting requires that the owner has experience in the renovation, repositioning and releasing of similar assets to the property being financed. In addition, sufficient owner net worth and liquidity is required to qualify for a bridge loan.

What Is the Structure of a Bridge Loan?

What Types of Income-Producing Commercial Real Estate Are Eligible for Bridge Loans?

The following types of leased income-producing real estate are eligible for bridge loans:

- Multifamily

- Manufactured Housing Communities

- Retail

- Office

- Industrial

- Hotels

- Self-Storage

Within these categories, the following sub-categories are also eligible:

Eligible Multifamily: Student Housing, Age-Restricted (Seniors) Multifamily, Furnished Multifamily, Multifamily with Section 8 voucher tenants, Multifamily with HAP contracts, Multifamily with IRS Section 42 tax credits.

Eligible Manufactured Housing Communities (MHCs; also known as Mobile Home Parks): MHCs with up to 20%-25% landlord-owned homes and MHCs with single-wide homes.

Eligible Retail: Malls, Anchored Multi-tenant Retail, Neighborhood Multi-tenant Retail, Unanchored Multi-tenant Retail, Single-tenant Retail (with long-term — 5-plus years — lease to a credit tenant and high likelihood of lease renewal).

Eligible Office: Multi-tenant Suburban Office, Multi-tenant Urban Office, Single-tenant Office (with long-term — 5-plus years — lease to a credit tenant and high likelihood of lease renewal), Government Office with no lease cancellation clauses.

Eligible Industrial: Multi-tenant Warehouse/Distribution, Multi-tenant Light Industrial, Single-tenant Industrial (with long-term — 5-plus years — lease to a credit tenant and high likelihood of lease renewal), Multi-tenant office/warehouse (office in front/warehouse in rear).

Eligible Hotels: Full-service, Select-service, Limited-service and Extended-stay hotels that are Mid-scale and higher franchised hotels as defined by Smith Travel Research. Independent hotels located on/near beaches, boutique hotels in urban/suburban locations with ADR over $100/night.

Eligible Self-Storage: Independent and franchised self-storage, climate controlled and non-climate controlled.

What Types of Properties Are Not Eligible for Bridge Loans?

Ground-up construction and projects that need to be closed down to complete substantial rehabilitation are not eligible for bridge loans.

Healthcare (defined as real estate with meals and health services provided) are not eligible for bridge loans.

Owner-occupied properties are generally not eligible for bridge loans.

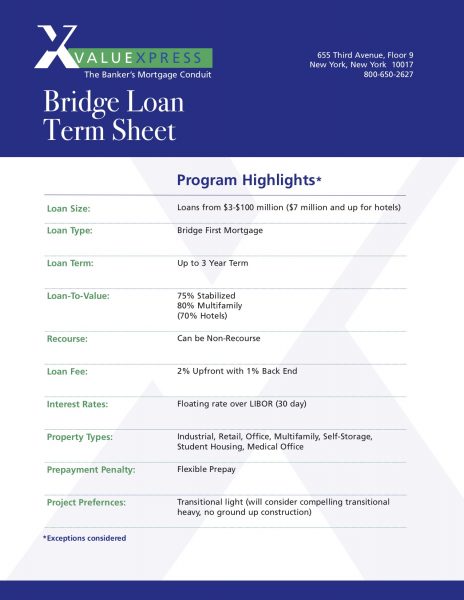

What Loan Amounts Are Available for Bridge Loans?

Bridge loans are available for loan amounts from $3 million to $100-plus million (except hotels). Bridge loans are available from $7 million for hotels.

Can Mezzanine Financing Be Added to a Bridge Loan?

No. Mezzanine financing cannot be added to a bridge loan.

What Property Condition Is Required to Be Eligible for a Bridge Loan?

Class A, Class B or Class C properties that will be upgraded to Class B properties are eligible for bridge loans.

Classifying commercial property is subjective, but if the property will be renovated and be competitive within its market it will likely qualify for a bridge loan. The best way to qualify a property is to contact your ValueXpress representative with the property address. Together, you can use Google Earth to look at the property and determine its eligibility.

What Is the Demographic Criteria for Bridge Loans?

Bridge loans are available for properties in all 50 states and Puerto Rico. Properties must be located in major metro, secondary or tertiary locations.

Properties located in a rural area (except for hotels located on a major highway) are generally not eligible for bridge loans. Determination of a rural location is subjective, but one general criteria is a population of less than 20,000 persons. Please contact your ValueXpress representative with the property address to determine if the property is ineligible for a bridge loan due to its potential rural location.

What Are the Costs to Obtain a Bridge Loan?

The bridge lender will charge an origination fee and an exit fee that is typically waived if refinanced through its permanent fixed rate program.

What Are the Prepayment Penalties for a Bridge Loan?

The prepayment penalty for a bridge loan is typically 1%. Often, the prepayment penalty on a bridge loan is completely waived if the loan is refinanced into a permanent CMBS conduit loan. If the loan is refinanced into an alternative loan, the prepayment penalty is typically 1% of the loan amount.

Residences at West Beach

Galveston, TX

$8,000,000 Bridge Loan

Important Documents

Click on one of the documents below to view it as a PDF. You can download documents by clicking the “download” button in the upper right hand corner of the PDF reader or by right-clicking on the document and selecting “Save As PDF.”