ValueXpress provides free, no-obligation loan quotes for your commercial loan transaction. We evaluate your property’s cash flow, and using our propriety Loan Sizing model, we will tell you how much the property is worth, how much you can borrower, what the interest rate will be and how much is will … [Read more...] about 12.18.19: VALUEXPRESS LOAN QUOTES ARE FREE!

12.15.19: CMBS MARKET REMAINS STRONG INTO YEAREND

Benchmark spreads on CMBS conduit securities tightened this past week despite a wave of new issues hitting the market before yearend. Bond buyers usually have reduced funds at this time of year as they typically have invested their annual allocations and often sit on the sidelines until the new … [Read more...] about 12.15.19: CMBS MARKET REMAINS STRONG INTO YEAREND

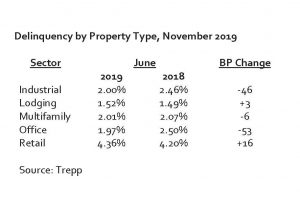

12.10.19: CMBS DELINQUENCY RATES CONTINUE TO DECLINE

The Trepp CMBS delinquency rate maintained its downward trend in November, falling sharply to another post-crisis low. The November reading was 2.34%, a month-over month drop of 13 basis points (bp). The delinquency rate is down 99 bp year over year. The delinquency rate started to fall after June … [Read more...] about 12.10.19: CMBS DELINQUENCY RATES CONTINUE TO DECLINE

12.5.19: CARLSBAD, NM HOTEL MARKET POWERED BY THE DELAWARE BASIN

Carlsbad, New Mexico is located 150 miles northeast of El Paso, Texas, in the southeastern section of New Mexico. It is well known as the gateway to the vast, bat-filled caves of Carlsbad Caverns National Park. But what’s really happening in Carlsbad involves oil and gas exploration and … [Read more...] about 12.5.19: CARLSBAD, NM HOTEL MARKET POWERED BY THE DELAWARE BASIN

12.2.19: REMEMBER: INTEREST-ONLY LOANS ARE AVAILABLE IN CMBS!

Unlike many commercial loan programs, CMBS conduit loans can provide for partial interest-only loan payments as well as full-term, interest-only loan payments for lower leverage loans. This structure provides higher cash flow after debt service to the sponsor, and it can be particularly useful in … [Read more...] about 12.2.19: REMEMBER: INTEREST-ONLY LOANS ARE AVAILABLE IN CMBS!

11.22.19: HOW TO ESTIMATE DEFEASANCE COSTS FOR A CMBS CONDUIT LOAN

Most CMBS conduit loans feature defeasance as the method for loan prepayment before maturity. In layman’s terms, the lender releases the mortgage lien in exchange for securities, usually treasury bonds, that produce enough cash flow to make the remaining loan payments as they come due. If the total … [Read more...] about 11.22.19: HOW TO ESTIMATE DEFEASANCE COSTS FOR A CMBS CONDUIT LOAN

11.15.19: HOW TO USE A DEFEASANCE CALCULATOR

Most CMBS conduit loans feature defeasance as the method for loan prepayment before maturity (click here for details). Several well-qualified firms handle the defeasance process on behalf of borrowers, and each has a defeasance calculator on its website. Let’s walk through an example of how to … [Read more...] about 11.15.19: HOW TO USE A DEFEASANCE CALCULATOR

11.11.19: WHY DOES VALUEXPRESS EXCEL FOR CLIENTS: EXPERIENCE!

The key individuals on the ValueXpress team have significant years of experience in the underwriting and closing of commercial loans, particularly CMBS conduit loans. Mike Sneden has 25 years of experience, and Dennis Suh, Gary Unkel and Jim Brett each have 15 years. This talented team is focused on … [Read more...] about 11.11.19: WHY DOES VALUEXPRESS EXCEL FOR CLIENTS: EXPERIENCE!

11.6.19: WHEN IS A CMBS CONDUIT LOAN PERFECT FOR YOU?

A CMBS conduit loan is perfect for the owner or buyer of a multi-tenant income producing property that is one of the following: multifamily, manufactured housing community, retail, industrial, office, hotel or self-storage. This borrower would be seeking to refinance or purchase one of these assets. … [Read more...] about 11.6.19: WHEN IS A CMBS CONDUIT LOAN PERFECT FOR YOU?

11.2.19: U.S. LODGING MARKET UPDATE

LW Hotel Advisors (LWHA) recently released its third-quarter U.S. lodging market update. According to Daniel Lesser, President and CEO, the near‐term lodging outlook appears choppy as prognosticators have downgraded projected 2020 national hotel revenue per available room (RevPAR) growth. While the … [Read more...] about 11.2.19: U.S. LODGING MARKET UPDATE