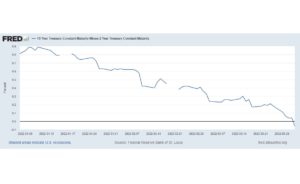

An inverted yield curve is an important economic indicator and is often a precursor to a recession. Normally, long-term interest rates are higher than short-term interest rates so a graphical plot of yields from Treasury bonds of different durations normally slopes up. One often-used graphic is the … [Read more...] about 4.1.22: YIELD CURVE INVERTS – WILL IT PREDICT A RECESSION?

5.23.19: 10-Year Treasury Yield Hits 18-Month Low

Investors abandoned risky assets after rising U.S.-China trade tensions quashed expectations of a near-term resolution, feeding concerns about economic growth and corporate earnings prospects. U.S. Treasury prices climbed amid a flight to quality, sending the yield on the benchmark 10-year note … [Read more...] about 5.23.19: 10-Year Treasury Yield Hits 18-Month Low

7.18.17: … While Using Debt Yield Allows for a Quick Size of a CMBS Conduit Loan

When time does not permit for a detailed loan sizing analysis, a reasonably accurate shortcut method can roughly determine the maximum CMBS conduit loan amount that can be offered to a borrower. The method utilizes a metric called “debt yield,” which is defined as the property net cash flow for the … [Read more...] about 7.18.17: … While Using Debt Yield Allows for a Quick Size of a CMBS Conduit Loan

5.16.14: 10-Year Treasury Yield Hits 9-Month Low; Swaps Follow

The yield on the benchmark 10-year Treasury note fell on Thursday, May 15, 2014 to close at 2.50%, a low not seen since last October. Intraday, the note touched 2.47%. Although investors have been expecting rates to rise, the bond market is not cooperating, confounding economists. Weak economic … [Read more...] about 5.16.14: 10-Year Treasury Yield Hits 9-Month Low; Swaps Follow

4.3.12: What’s the Direction of Debt Yield on CMBS 2.0 Issues?

Since the restart of the CMBS market in June 2010 when JPMorgan issued $716 million of CMBS, market participants have focused on a metric called debt yield. Debt yield is the property net cash flow (generally defined as actual income and expenses including management fees less capital reserves … [Read more...] about 4.3.12: What’s the Direction of Debt Yield on CMBS 2.0 Issues?