ValueXpress has arranged a $3.2-million CMBS conduit loan for the refinance of a 66-site manufactured housing community (MHC) located in Eugene, Oregon. All the homes are double-wide units. The transaction provided over $2 million of cash-out proceeds to the owner. The market for housing in Eugene … [Read more...] about VALUEXPRESS ARRANGES $3,200,000 CBMS CONDUIT LOAN FOR THE REFINANCE OF A 66-SITE MANUFACTURED HOUSING COMMUNITY (MHC) IN EUGENE, OR

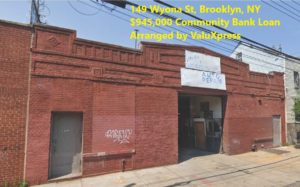

VALUEXPRESS OBTAINS $945,000 COMMUNITY BANK LOAN FOR THE PURCHASE OF A 5,000 SF INDUSTRIAL BUILDING FOR CONVERSION

ValueXpress has arranged a $945,000 loan from a N.Y.C.-based community bank for the purchase of a 5,000-square-foot industrial building constructed in 1930. The structure will be renovated and converted to mixed-use retail and warehouse space. Both the community bank and the buyer are repeat clients … [Read more...] about VALUEXPRESS OBTAINS $945,000 COMMUNITY BANK LOAN FOR THE PURCHASE OF A 5,000 SF INDUSTRIAL BUILDING FOR CONVERSION

7.25.20: SMALL NEW JERSEY COMMUNITY BANK LEVERAGES TECHNOLOGY TO DELIVER $5.4 BILLION IN PPP LOANS

Cross River Bank of Fort Lee, N.J., with net assets of just $2.5 billion, partnered with more than 30 tech firms to create an agile lending platform that provided over $5.4 billion in Payment Protection Program (PPP) loans. The privately held lender earned $160 million in fees, according to S&P … [Read more...] about 7.25.20: SMALL NEW JERSEY COMMUNITY BANK LEVERAGES TECHNOLOGY TO DELIVER $5.4 BILLION IN PPP LOANS

VALUEXPRESS ARRANGES $3,200,000 CBMS CONDUIT LOAN FOR THE REFINANCE OF A 66-SITE MANUFACTURED HOUSING COMMUNITY (MHC) IN EUGENE, OREGON (POST-COVID)

ValueXpress has arranged a $3.2-million CMBS conduit loan for the refinance of a 66-site manufactured housing community (MHC) located in Eugene, Oregon. All the homes are double-wide units. The transaction provided over $2 million of cash-out proceeds to the owner. The market for housing in Eugene … [Read more...] about VALUEXPRESS ARRANGES $3,200,000 CBMS CONDUIT LOAN FOR THE REFINANCE OF A 66-SITE MANUFACTURED HOUSING COMMUNITY (MHC) IN EUGENE, OREGON (POST-COVID)

ValueXpress Obtains $2,915,000 Loan for the Refinance of a 65-Site Manufactured Housing Community (MHC) in Henderson, NV

ValueXpress has arranged a $2,915,000 CMBS conduit loan for the refinance of a 65-site manufactured housing community located in Henderson (Las Vegas), Nevada. Most of the homes are double-wide units and half of the sites are occupied by RVs. The property was unencumbered, and the entire loan … [Read more...] about ValueXpress Obtains $2,915,000 Loan for the Refinance of a 65-Site Manufactured Housing Community (MHC) in Henderson, NV

ValueXpress Secures a $1,443,750 Community Bank Loan for the Purchase of a Warehouse in Houston, TX for Long-Time Client

ValueXpress obtained a $1,443,750 first-mortgage loan that was utilized to purchase a 32,800-square-foot, two-building warehouse complex located at 510 Midland Avenue in Houston, Texas. The building will be owner-occupied by an affiliated company owned by the client. The loan was arranged by … [Read more...] about ValueXpress Secures a $1,443,750 Community Bank Loan for the Purchase of a Warehouse in Houston, TX for Long-Time Client

ValueXpress Arranges $9,000,000 Community Bank Loan to Refinance a 103-Room Wingate by Wyndham Hotel Located Near JFK Airport

ValueXpress obtained a $9,000,000 community bank loan to refinance a construction loan that was utilized to construct a 6-story, 103-room Wingate by Wyndham hotel located minutes from John F. Kennedy (JFK) airport. This transaction is the second closing completed by ValueXpress for this client. The … [Read more...] about ValueXpress Arranges $9,000,000 Community Bank Loan to Refinance a 103-Room Wingate by Wyndham Hotel Located Near JFK Airport

9.29.17: Reach Out to Community Banks for CMBS & Non-CMBS Opportunities

ValueXpress is always looking for effective avenues to find borrowers that may be interested in CMBS conduit loans. Until recently, a steady source of CMBS conduit loan originations resulted from refinancing maturing 10-year term CMBS conduit loans closed in 2006-2007 during the height of the CMBS … [Read more...] about 9.29.17: Reach Out to Community Banks for CMBS & Non-CMBS Opportunities